Table of Contents

Last Updated on August 4, 2023 by admin

B2B fintechs, like other B2Bs, have a longer buyer’s journey and sales cycle. It’s about building relationships at every stage in that buyer’s journey and making sure your prospects have the information they need to make an informed decision. That’s where fintech lead nurture campaigns come into play.

Educating an audience includes building awareness about your organization, building credibility and trust, and demonstrating positive case studies that show your products and services do what they promise. It’s about having a conversation with your prospect as they move from point A to point B to point C.

Like any relationship, it requires nurturing. It’s not a one-and-done endeavor. You need to woo and court prospects, which takes time and investment in the long-haul. It means fine-tuning your fintech lead nurture game. Here are a few ways to do that.

1. Personalize fintech lead nurture campaigns

If your idea of a solid fintech lead nurture strategy is to send out errant email blasts to your entire list, stop. Lead nurturing requires a personal touch…which requires list segmentation.

Effective list segmentation means you must have enough information about the people on your list to effectively split them into meaningful groups. Some ways to do this are to organize audiences based on marketing persona and lifecycle stage.

Once you have segmentation in place, you can personalize your lead nurture emails to the interests, motivations, and behaviors of your leads and prospects. Get creative with other ways you can personalize, including testing subject lines, the “to” and “from” fields, and your sign-off.

2. Map lead nurture flows to the buyer’s journey

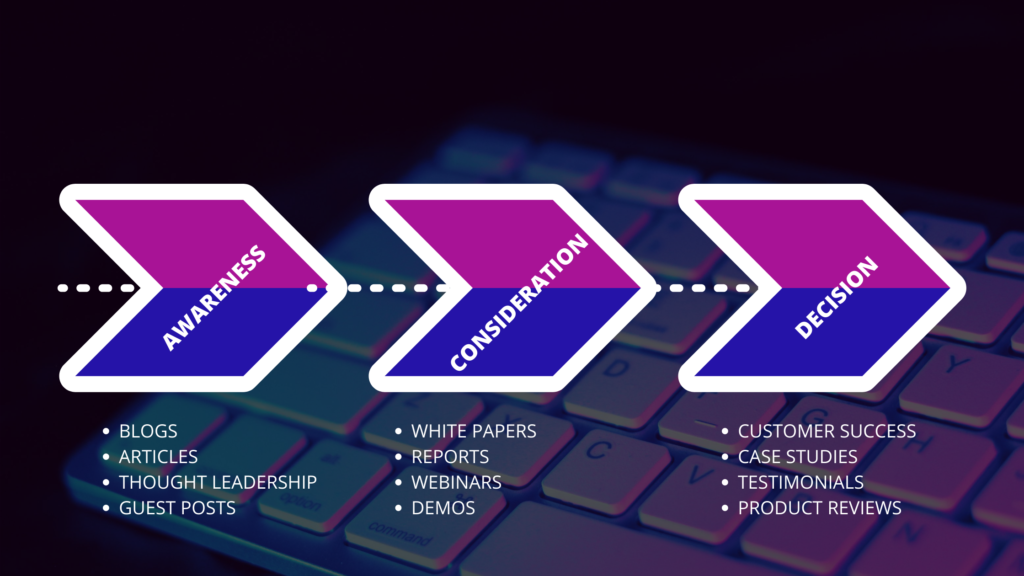

Educating an audience is helpful, but giving your prospects the personalized information they need based on where they are in the buyer’s journey is priceless. You’ll need a high-quality trove of content to do this well, and you’ll also need content for every stage of the buyer’s journey. For example:

- Awareness: Blog articles with general information tied to prospects’ interests and relevant industry information.

- Consideration: Webinars, reports, thought leadership, and demos that connect industry problems to your solutions.

- Decision: Case studies, customer success stories, and product reviews.

Leverage analytics to discover what types of content are resonating most with your prospects and use that to inform your content calendar and how you build your fintech lead nurture campaigns. Think about people’s pain points, motivations, objections, questions, and concerns.

Include CTAs and clear next steps in your emails, directing people as to what their next action should be. Responses to these CTAs are additional data points that you can use to inform and iterate on campaigns.

3. Make your customer the hero

When creating content for use in fintech lead nurture campaigns, make sure you position the lead as the potential hero. The most effective content stays away from self-promotional messaging and instead aims to provide useful information.

The actual content of your emails should build a narrative that allows the prospect or lead to see how your products and services can help them achieve their desired outcomes — both for themselves and for their organization.

This requires empathy and a deep understanding of both the professional challenges the lead faces as well as the emotional ones. Tapping into buyer psychology is extremely important. If you’ve done your homework with personas, this will be a lot easier.

4. Start your fintech lead nurture campaigns…yesterday

Fintech lead nurturing is critical and it can be implemented right away. You don’t need a list of leads that have expressed purchase intent. IN fact, the earlier you start, the better. Even people who have just become aware of your business and subscribed to your blog can be catered to in lead nurture campaigns.

The idea is to send a steady stream of helpful, relevant content with a ‘next step’ or offer of some kind. Each action a prospect takes can potentially shift them into a different nurture campaign. Keeping lead nurture campaigns tight and focused allows for more personalization and effective routing. It’s a great way to move a subscriber to a lead to a customer.

5. Use Behavior-based marketing automation

Much of what we have described about fintech lead nurture campaigns may sound fairly complex. If you’re doing it right, it is. Making sure the right information gets in front of the right eyes at the right time can be extraordinarily difficult to do on its own, but it’s also especially time-consuming.

Leveraging behavior-based marketing automation allows you to do just that in a fraction of the time. It allows you to scale lead nurturing operations and make them as precise as possible. The goal is to facilitate authentic conversations with people, but one or two people can only manage so many of those conversations at once. Tapping a marketing automation technology can streamline the process, scale capabilities, and automate a lot of the grunt work that drains times and resources.

It’s easy to forget that the sales process is all about relationships. Lead nurturing is a way to grow relationships with your prospects and leads over time. Yes, it’s a complicated process, but it’s worth the effort in the end. Take the necessary time to set up a solid lead nurture strategy and to implement all the essential tools. Over time and with tweaks, you’ll have a well-oiled lead nurturing machine that converts.

If you’re just getting started with your fintech lead nurture campaign, check out our Guide on Lead Generation for a more detailed primer.