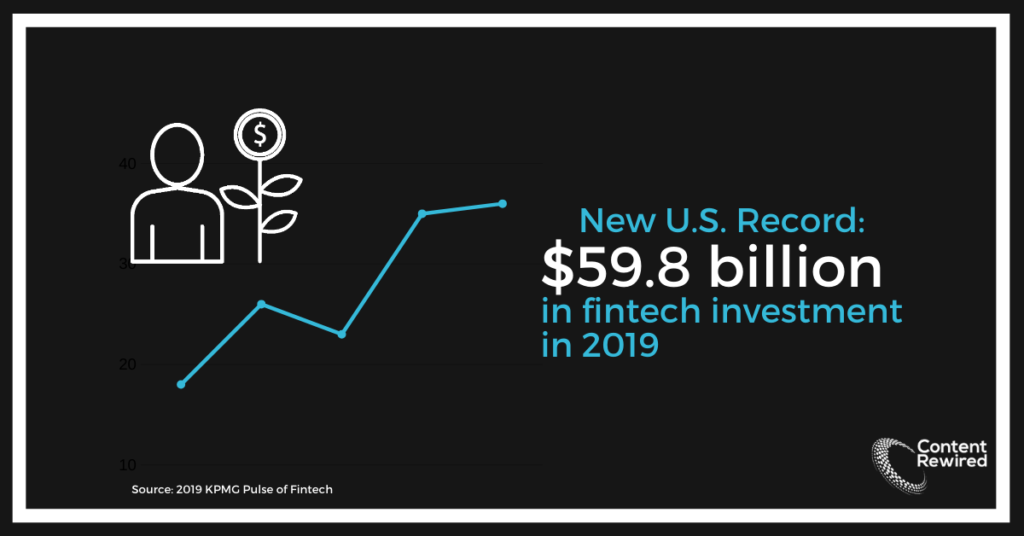

FinTech continues to see explosive expansion, with a large portion of that growth sprouting from the B2B fintech sector. Payments platforms and SaaS-based back-office tools continue to lead the growth in B2B fintech. In looking at the fintech market overall, the US crushed a fintech funding record in 2019, achieving $59.8 billion in investment (compared to $58 billion the year prior). Some of the biggest points of consolidation include the Fiserv acquisition of First Data, the Deutsche Boerse acquisition of Axioma and the Prudential acquisition of Assurance IQ.

As this growth and consolidation continue — especially within B2B fintech — many organizations are looking to strengthen their B2B fintech marketing strategy. While there seems to be much ado about challengers vs incumbents and fintechs vs banks, it would appear that many B2B fintechs actually offer complimentary offerings to traditional financial institutions. This is a boon for various B2B fintech business models that can leverage synergy to remain scalable.

What’s really of interest is the marketing challenges that B2B fintechs face, many of which are unique to the industry. Customer acquisition, in particular, can be a difficult objective for B2B fintech marketing departments to achieve. Here’s why:

- Buyer education is paramount; B2B buyers don’t know what they don’t know. Educating these buyers on what problem your solution solves is mandatory

- B2B fintech startups that haven’t established brand recognition may struggle to gain a foothold in the market

- B2B buyers are wary and often slow to adopt an unfamiliar or unpredictable product/solution

Not acknowledging these challenges can lead to holes in your B2B fintech marketing strategy. That said, these customer acquisition challenges can be addressed by looking at the buying process as well as who is doing the buying. We’ll discuss some potential holes in your B2B fintech marketing strategy and how to close the gap.

Not Identifying the Correct Decision-Maker(s)

Know this: companies in search of fintech solutions rarely purchase via one decision-maker. One CCgroup’s report, How To Influence FinTech Buyers, notes that more than half (52%) of respondents said that IT decisions involved at least 10 people. Influencing decision-makers means properly identifying who that group entails, which can often be a disparate group of people.

B2B fintechs looking to sell to a larger institution may often need to communicate with various members of the C-suite in addition to leads within marketing, compliance, security, IT, and payments. That means messaging will need to appeal to this diverse crowd and aim to impress/allay fears of each audience member.

B2B fintech marketing teams need to demonstrate value to each member of the decision-making group, including both technical and non-technical roles. This starts with clear identification and persona-building around all key stakeholders involved in the purchase process.

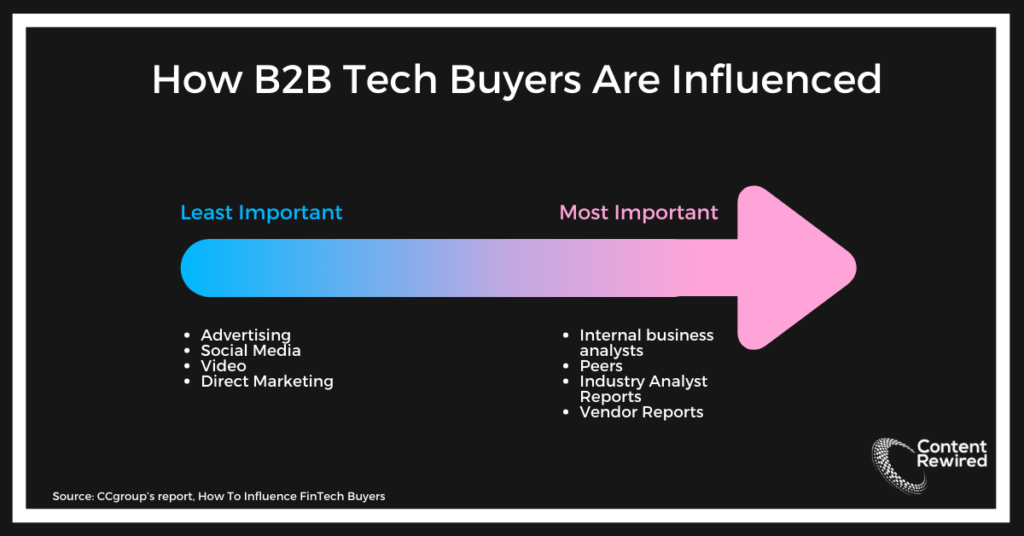

Not Understanding How Buyers are Influenced

The CCgroup report also identified key factors that influence the purchasing process. The question the survey specifically asked was: what sources and channels of influence most valued by decision-makers? The responses were then ranked in order of importance. The top sources of influence included:

Internal business analysts – large companies often tap in-house business analysts to seek out options to improve business processes. These analysts then parse information from various sources like trade media and industry analysts to arrive at a list of options.

Peers – organizations also rely on the input of their peers, though this requires an elevated level of effort, time and trust.

In terms of content that decision-makers find influential, the report suggested that the following are most important:

Industry analyst reports – Independent assessments of a market sector solution from an expert can provide unbiased information about specific solutions.

Vendor reports – Reports and white papers that deep dive into an industry issue and explain how technology can solve that issue are prioritized. Not only do these highlight the vendor as a viable solution but they also provide an expert look into an important industry problem.

Opinion articles – While these rank as “important” rather than “most important”, thought leadership can play an important role in the decision-making process. It demonstrates that a vendor has a finger on the pulse of market issues and understands their customers’ businesses. This type of content can make or break a sale, especially in highly competitive sectors.

Taking this information about sources and content into account, the action step for B2B fintech marketers becomes clear: create content on relevant industry issues/problems and ensure that content gets distributed via channels where your buyers are spending time.

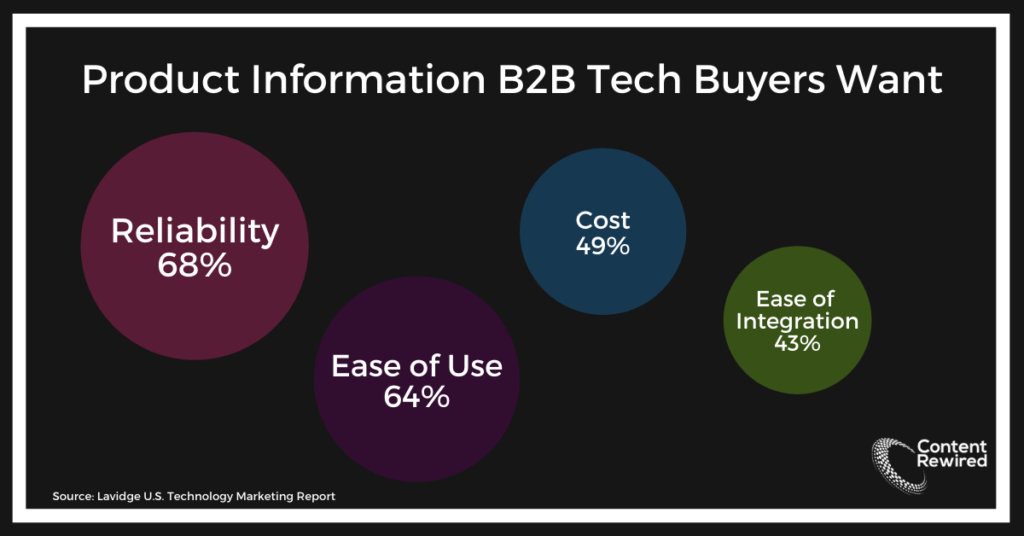

Not Providing the Right Information

While creating educational content around industry trends and issues is critical — especially at the awareness stage — providing the appropriate information about your product or service is, too. It’s surprising how many B2B fintechs miss the boat on this. The Lavidge U.S. Technology Marketing Report points to some of the following essential nuggets of product information:

- Reliability (68%)

- Ease of use (64%)

- Cost (49%)

- Ease of integration (43%)

Obviously a successful B2B fintech marketing strategy must extend beyond product specs. Finding a way to effectively weave this information into marketing materials and campaigns at the appropriate stages is important. Consider the following flow of content by stage:

Awareness: B2B fintech buyers are looking for vendor expertise and awareness of industry trends and issues.

Evaluation: B2B fintech buyers are looking for vendors that also have an awareness of how those trends and issues affect their customers.

Decision: B2B fintech buyers are looking for stories and evidence that demonstrates how a vendor has successfully solved a problem for other customers.

The bottom line is that each group of B2B fintech buyers will have unique needs that your marketing team will need to meet. This means B2B fintech marketing teams need to do their homework on identifying the right decision-makers, how those decision-makers will relate best to the solution, and what types of information they will need to get them over the hump, around the doubts, and through to a purchase.

Looking for more granular information about B2B fintech marketing? Download our Fintech Marketing Playbook.