This article is the third in a series that will deep-dive into the world of storytelling for complex industries like fintech. This week, we look at the fintech customer acquisition problem. This article is authored by and based on the experience of our CEO & Chief Storytelling Officer, Ashley Poynter. View part 1 and part 2.

Quick recap: Last week we talked about how content without context or connection is just white noise. Emotion is the missing ingredient to successful storytelling and content marketing for B2Bs.

Fintech Customer Acquisition Challenges

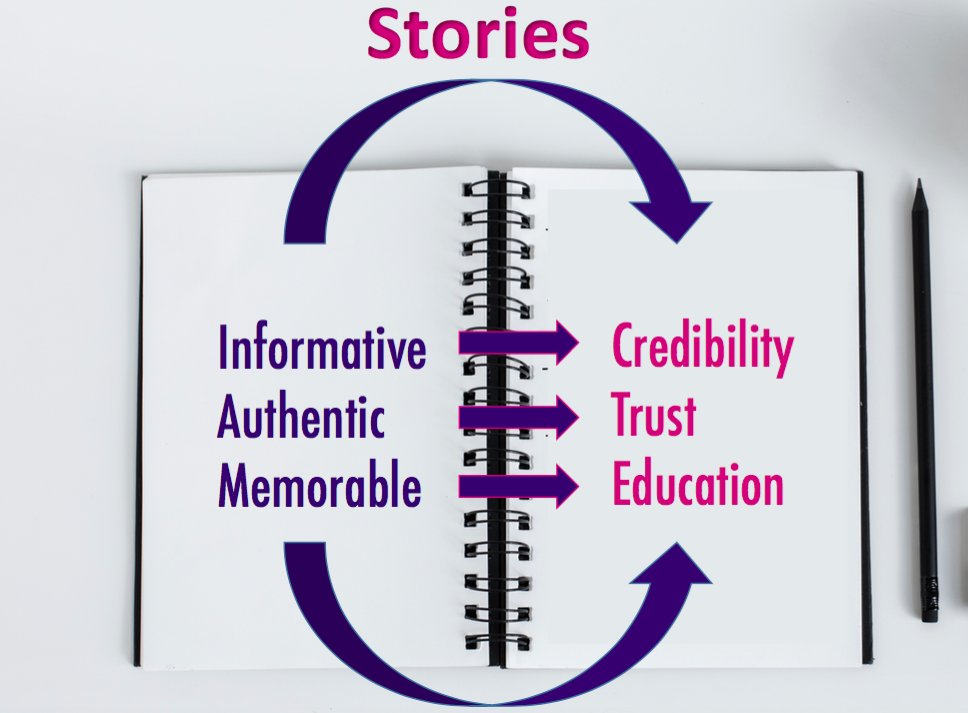

Fintechs that serve other businesses face a compound problem. As a B2B business, they must also overcome the risk hurdle by tapping into buyer emotion. Credibility, trust, and education are also key factors that can negatively impact fintech customer acquisition.

- For one, Fintech startups have not yet established brand recognition (Credibility)

- It’s also hard to convince potential buyers to adopt an unfamiliar or unpredictable product/solution (Trust)

- And Innovative solutions require buyer education – sometimes your prospects have been settling for a workaround or poor substitute for so long that they don’t realize an alternative is possible (Education)

Content alone is not enough to surmount fintech customer acquisition hurdles—especially when it comes to trust and credibility, which require a deeper, more meaningful level of connection with prospects.

How Stories Bridge the Gap for Fintechs

Storytelling—done well—can bridge some of these gaps and foster that emotional connection needed for fintech customer acquisition.

- Informative stories that demonstrate real-life resolutions to key problems attract an audience, amplify word of mouth, and build up brand credibility.

- Authenticity in storytelling can build trust while communicating the business value effectively.

- Memorable stories simplify complex concepts and help buyers wrap their minds more easily around innovative solutions that they have never seen before.

Stories are an engaging, interesting way to educate and build trust and credibility with the people you’re trying to sell to—and others that may have a say along the way. On the other hand, not controlling your narrative —or not having a narrative—can push people away from your business as a viable solution to their problems. Because if you’re not filling in the blanks, your audience is.

Don’t Be Like Aaron

I remember one time I was at a networking event and I was in a conversation with a group of people who were all standing in a circle. We introduced ourselves and were each talking a little bit about what we do. We all came from fairly different industries, so each of us also added on a story to help illustrate our roles at our respective companies. When it was my turn to speak, I said: “I’m Ashley, I’m a content marketer at X company.”

Right away, I noticed the blank looks on some people’s faces that signaled they were somewhere in the realm of “Cool, what the hell does that mean?” in their heads. To combat confusion, I added context by speaking to the chargeback superhero story I created for Frank (see part 1). Then, the light bulbs started to flicker on. “Oh, I get what she does.”

Everyone went around the circle and sprinkled in their own stories about what they do.

Except for one guy. He just said, “Hi, I’m Aaron, and I’m a financial advisor.”

Later on in the evening, I was mingling with two women who were a part of that circle. One of the women asked me, “Hey, what does that Aaron guy do again? Was he an investment banker?” Before I could even eke out one work, the other woman chimed in, “No, no. I think he was an analyst.”

I’m guessing that was not a successful networking event for Aaron.

That’s how people feel about your business when you’re not an active participant in your own narrative. You are either not remembered or people fill in their own blanks around what you do.

On the other hand, who do people trust, warm to, and look to for advice and guidance? The leader of the pack. The outspoken one. The one who isn’t afraid to have a little personality, be authentic and drive the conversation.

Your audience is curious. They want to know. And if they aren’t getting input, they’re creating their own (hint: not good).

Lackluster or unmemorable stories can have the same effect. If you’re presenting information about your business in a 2 dimensional light 1) you’re doing a disservice to your brand, and 2) you’re doing a disservice to the people looking for the solution that your company offers. Your missing an important opportunity to tell a meaningful story that spurs important conversations and educates people.

We know buyers prefer self-directed research especially in the early stages. Fintechs that are active participants in creating and promoting their story will be in a better position to influence buyers and later on, to win those deals.

Stay tuned next week for the following part of the series. In the meantime, download our Fintech Marketing Playbook to get a winning strategy for telling better stories that help with fintech customer acquisition.

1 thought on “Fintech Stories: The Fintech Customer Acquisition Problem”

Pingback: Is Your Fintech Marketing Strategy Missing Important Pieces? – Cryptofinity OU