Table of Contents

Last Updated on December 8, 2020 by admin

Getting the messaging right and telling interesting stories is just half of the equation when using content marketing as a customer acquisition tool for fintech. You also need to promote your content, offers, products, and services to people navigating each stage of the buyer’s journey. To be sure that you’re reaching the right people, you need to determine which channels make the most sense for promotion and amplification.

Exactly how you do this will depend on your unique audience(s) and where they prefer to consume content. This may include industry or trade publications (print or online), social media, and email, to name a few. We’ll look at how to leverage some of these distribution vehicles below.

Thought Leadership Placements

For many organizations, publishing thought leadership pieces in industry publications is a great way to drive awareness among highly-relevant audiences. The first step is to research fintech publications that accept guest posts. Connecting with editors and submitting thought leadership stories/articles for placement help build trust and credibility while educating an audience. The added benefit is that you get to appear in front of an audience that you might not otherwise get in front of. Leveraging existing media publications to broaden reach is a solid strategy.

This is a tactic we use for clients often. We’ve collected submission information on a few publications that you can borrow to establish your own guest post program.

FinTech Weekly

FinTech Weekly accepts guest posts that follow the editor’s guidelines below:

- Will publish relevant content contributed by industry experts.

- No word count limit or deadlines for articles submitted, but be advised that readers tend to disengage from very long articles.

- Enforce a strict non-advertising policy, meaning article cannot contain outlinks to a product or company or be interpreted as advertising in any other way (direct reference to the author or the author’s company in a “bold” way).

- Author and company bio/links will be added to articles above and under article body.

- No articles about gambling or related topics

- Articles are published in FinTech Weekly Magazine and on fintechweekly.com.

- Articles are also promoted via FinTech Weekly’s newsletter that goes out to more than 20,000 professionals within finance, technology, and digital businesses.

- Articles will also be promoted in the online version of newsletter. That, in combination with the listing in the magazine, accounts for an additional 25,000 visitors in addition to 5,000 users on the mobile app.

PaymentsJournal

PaymentsJournal accepts guest posts that follow the guidelines below, as outlined in this message from the editor:

- Articles are not due on deadline and can be published as submitted..

- Advertorials for companies are restricted. Content must not include promotional backlinks but may include backlinks to data sources.

- Articles should aim to be around 700 words in length for SEO and readability

- Submitted content must include the author’s name, title, and headshot for attribution. Author bios may also be included if submitted.

PaymentEye

PaymentEye accepts guest posts that follow the guidelines below. You can view the full guidelines on their Editorial Guidelines page:

- Accepts submissions that explore in-depth specific payment methods/trends are also welcome.

- Articles should aim to be between 1000-1500 words in length. Regular contributing writers can submit articles around 800 words that express the author’s personal opinion.

- Articles must be submitted as Word document format only, but may be accompanied by graphics and visual information in high-quality formats.

- Articles should be submitted with contact details, including author photograph, brief biography, and a company logo.

- Article submissions must be unique to PaymentEye and should not have been published elsewhere prior. Articles may be re-published after PaymentEye, but the content must carry the caveat ‘first published on PaymentEye’ in the footer.

- Advertorials and unwarranted references to company, its services, or its capabilities are not permitted and will be removed from submitted articles.

Email Marketing

Email marketing is a vast umbrella under which many different tactics fall. Enewsletters have continued to rise as an effective marketing tool. Email as a component of marketing automation can be a highly effective way to stay top-of-mind with prospects and current customers (and former customers) without having to dedicate time and resources to repetitive tasks. No matter how you leverage email marketing, the most critical consideration in 2020 is ensuring that you are personalizing your message for your recipient. Why?

- According to Econsultancy, 80% of companies report seeing an uplift since implementing personalization.

- Marketers report that personalization efforts can boost revenues by up to 15%, according to Adweek.

- Evergage notes that 86% of marketers have seen a measurable lift in business results from their personalization campaigns.

- 95% of companies that saw 3x ROI from their personalization efforts increased profitability in the year after their personalization efforts, according to Monetate.

- Adweek also points out that personalization can reduce customer acquisition costs by up to 50%.

Personalization is especially important and can be tackled in a variety of ways:

Past Engagement

Take a page from Amazon’s book and personalize email campaigns based on past engagement. Gather insights from data to see where customers interacted with your brand previously and send personalized emails based on that information. That may include customized discounts or offers or information tailored to their interests.

Location-Based Personalization

Tapping location information can aid in personalizing messages and offers for customers and prospects. This should only be used where relevant, but if you provide services that may be useful to businesses in a state that has specific legal or compliance requirements, for example, this can be a great tactic to use.

Interest-Based Personalization

Using personal information and insights about what customers are interested in is a great way to tailor email marketing. Sending curated offers or information is an effective way to engage your audience and show them that you’re paying attention.

Social Media

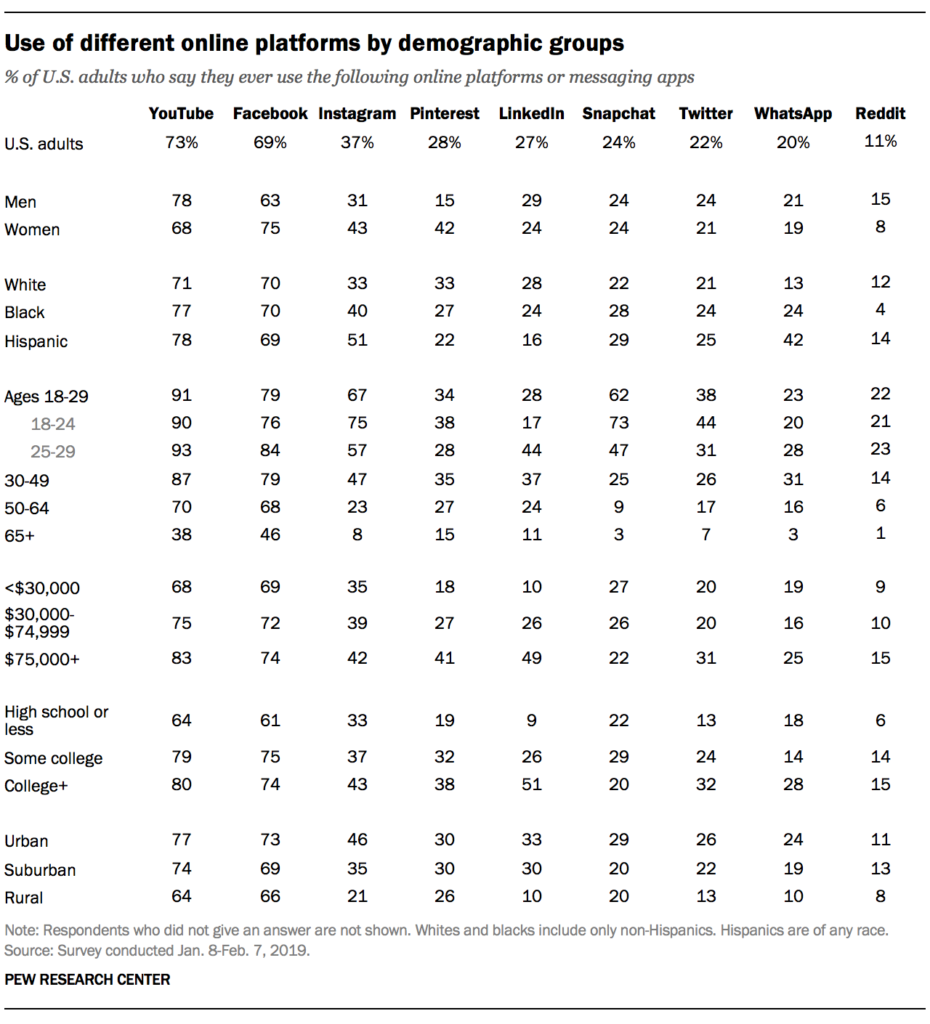

While social media is not often the “go-to” channel for B2B fintech companies, there are some circumstances that warrant having a social presence. Channels like LinkedIn and Twitter have prominent fintech followings and groups that can be helpful for promoting content to a targeted audience. Whether and how you promote content on social media will depend on your organization’s unique circumstances and how your audience prefers to receive information. If you do amplify content on social media, consider the following Pew Research chart that includes some compelling data on where you’ll find different segments of the US population spending time:

Ready to take promotion and amplification to the next level in your customer acquisition efforts? Download the Fintech Customer Acquisition Playbook.