Table of Contents

Last Updated on August 21, 2023 by admin

Capturing demand and driving qualified conversions in fintech is essential for sustained growth and success. This is where fintech demand generation content is integral. Fintech organizations must adopt a demand-generation approach to their content marketing strategies to effectively generate leads and attract prospects interested in their products, services, and solutions.

Leveraging the power of fintech demand generation content allows organizations to cultivate engagement, build trust, and ultimately drive conversions from their target audience. In this article, we will explore nine impactful ways fintech companies can utilize content to improve their demand generation operations, focusing on driving qualified conversions.

Important Thoughts for Fintech Demand Generation Content

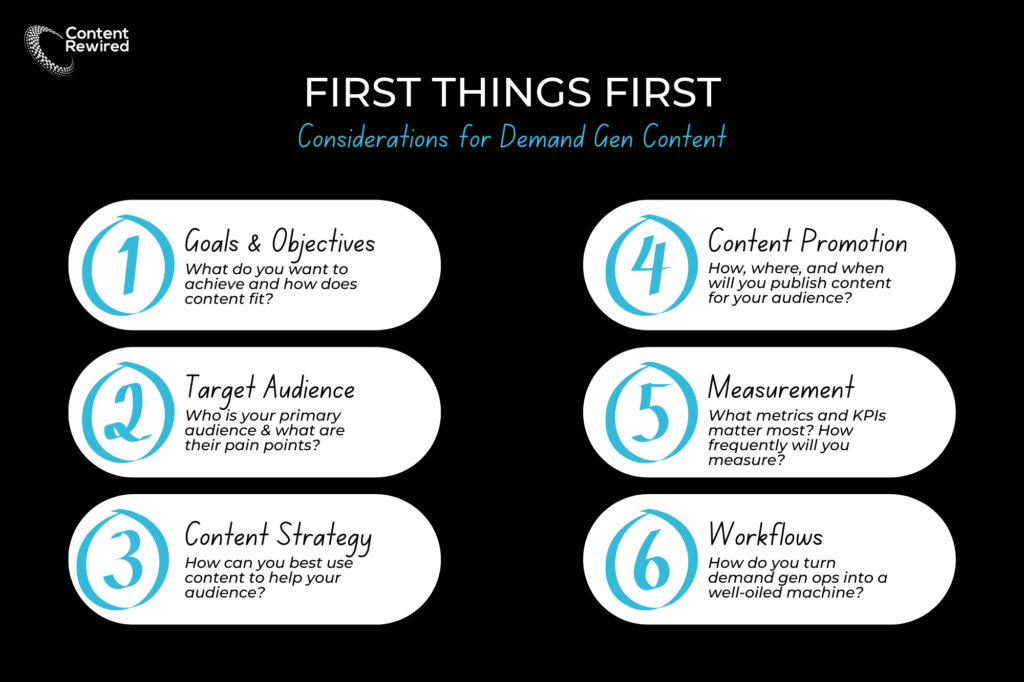

We’ll dive into a few of these in a bit more detail below, but the following are crucial considerations when creating fintech demand generation content:

- Goals & Objectives: What do you want to achieve? What are your demand generation goals and how do they fit into the broader marketing strategy? How does content fit into both?

- Target Audience: Who is your primary target and their influencers? What are their main pain points and how does your service/solution/product solve them?

- Content Strategy: What are the best ways to use content to address audience pain points? What are the best types of content and formats? What are the main topics? How often will you publish?

- Content Promotion: How will you target qualified traffic? What are the best ways to get content in front of your primary audience? What are the top channels and how frequently should you push out content?

- Measuring Success: What are the KPIs that will inform your success? What metrics matter most? Who is responsible for tracking and making recommendations?

- Content Workflows: How do you turn demand gen content operations into a well-oiled machine? Who is responsible for what? Who are the key stakeholders? How frequently will you check in and iterate?

These considerations set the stage for a successful fintech demand generation content program. Now, let’s get into a little more detail.

Define Buyer Personas for Targeted Messaging

To drive qualified conversions, fintech organizations must first understand their target audience. Creating detailed buyer personas helps in crafting tailored content that resonates with specific segments of the market.

These personas should encompass demographic information, pain points, goals, and preferred communication channels. By aligning content with the needs and preferences of each persona, you can attract and engage the right prospects, increasing the likelihood of qualified conversions.

Aim to align content with the characteristics and behaviors of your ideal customers. This attracts the right audience and allows the organization to nurture them through the conversion funnel. Moreover, accurate buyer personas enable you to personalize your content and deliver it through the appropriate channels, maximizing the chances of capturing demand and driving qualified conversions.

Buyer personas serve as a guiding compass, enabling you to create content that speaks directly to your target audience and increases the effectiveness of your demand generation efforts.

Develop Educational and Informative Content

Fintech demand generation content should go beyond promotional materials. Educational and informative content establishes credibility and positions your organization as a thought leader in the industry. This content can include blog posts, whitepapers, e-books, and webinars, providing valuable insights and knowledge to the target audience.

Trust and credibility are paramount in fintech, and informative and educational content establishes your organization as a thought leader and builds trust with your target audience. The right content provides valuable insights, expert knowledge, and actionable advice that positions fintechs as trusted advisors in the industry.

Educational content helps address the pain points and challenges faced by prospects, offering practical solutions and demonstrating your company’s expertise. This approach not only attracts the attention of potential customers seeking information but also nurtures them through the conversion journey, establishing your brand’s credibility and increasing the likelihood of qualified conversions. By consistently delivering informative and educational content, you can cultivate engagement, loyalty, and long-term relationships with your audience.

Implement SEO Strategies

Search engine optimization (SEO) plays a pivotal role in driving organic traffic and enhancing the visibility of fintech content – and marketers know it. According to HubSpot, 88% of marketers who use SEO on their websites will increase or maintain their investment this year. By conducting keyword research and optimizing website pages, blog posts, and other content assets, fintech organizations can rank higher in search engine results, attracting relevant prospects actively searching for solutions.

Incorporate target keywords related to your sector, products, services, and industry challenges to ensure visibility and increase the chances of capturing qualified conversions. Conduct comprehensive keyword research and optimize your website pages, blog posts, and other content assets to improve search engine rankings and ensure that your content appears prominently in relevant search results. This increased visibility translates into higher chances of capturing the attention of prospects actively seeking solutions.

SEO optimization also helps align content with the search intent of your target audience. This allows you to address the right pain points with the right information at the right time. Consistent implementation of SEO best practices will boost your ability to drive qualified traffic to your website, engage prospects, and maximize your chances of converting them into loyal customers.

Leverage Social Media Platforms

Social media platforms are an effective channel to promote demand generation content and engage with your target audience. Sharing valuable content on LinkedIn, Twitter, Facebook, and any other relevant platform helps you generate awareness, spark conversations, and drive traffic to your website. And you’ll be in good company; 96% of B2B marketers use LinkedIn for content publishing and 83% use paid social on LinkedIn making it the most popular channel for B2B businesses. Encourage social sharing and interaction to extend the reach of the content, touch a broader audience, and increase the potential for qualified conversions.

Create Video Content

Video content has become increasingly popular and influential in the digital landscape. Fintech organizations can leverage this medium to captivate their audience and engagingly communicate complex concepts. Explainer videos, product demos, and client testimonials are just a few examples of video content that can effectively drive demand and qualified conversions. Including video content in demand generation campaigns helps increase engagement, build trust, and enhance conversion rates.

Incorporate Interactive Content

Interactive content is a powerful tool for driving engagement and capturing demand. Fintech organizations can create quizzes, calculators, assessments, and interactive infographics that enable prospects to participate and receive personalized results actively. This interactive experience not only increases the time spent on a website but also provides valuable insights into the prospect’s needs and preferences. By collecting user data, fintechs can nurture prospects with targeted content, guiding them toward qualified conversions.

Implement Marketing Automation

Marketing automation streamlines demand generation efforts and nurtures leads through the conversion funnel. Use marketing automation tools to deliver personalized content, triggered emails, and tailored campaigns based on prospect behavior and interests. Automated workflows ensure consistent communication and engagement, maximizing the potential for qualified conversions. Marketing automation also enables efficient lead scoring and tracking, allowing organizations to prioritize efforts on the most promising prospects. It’s a great way to make sure you get the most out of your fintech demand generation content.

Incorporate Account-Based Marketing (ABM)

Account-Based Marketing (ABM) is particularly effective for fintech organizations targeting specific industries or high-value clients. By personalizing content and campaigns for individual accounts, you can create a tailored approach that resonates with key decision-makers. ABM focuses on building relationships, delivering relevant content, and nurturing trust within target accounts. By aligning sales and marketing efforts, you can increase the likelihood of qualified conversions from your most valuable prospects.

Measure, Analyze, and Optimize

To drive continuous improvement in demand generation efforts, fintech organizations must measure and analyze the performance of their content. Key metrics to consider include website traffic, engagement rates, conversion rates, and customer acquisition costs. By leveraging analytics tools and conducting A/B testing, you can identify areas for improvement and optimize content marketing strategies. Regular monitoring and adjustment ensure that demand generation efforts remain effective and drive qualified conversions.

Finding Success With Fintech Demand Generation Content

Fintech demand generation content serves as a powerful driver for capturing demand, engaging prospects, and driving qualified conversions. By taking a strategic approach to content marketing, fintech organizations can attract the right audience, establish thought leadership, and foster trust.

Remember, it’s a process. In fact, 96% of your website visitors might not be ready to buy yet. It’s a marathon, not a sprint. Through techniques such as defining buyer personas, creating educational content, implementing SEO strategies, leveraging social media platforms, and utilizing video and interactive content, fintechs can amplify their demand generation efforts. With marketing automation, ABM, and continuous measurement and optimization, you can drive sustained growth and achieve your conversion goals. With the right strategy and the right execution, fintech demand generation content can ultimately boost your bottom line in the competitive fintech landscape.