Table of Contents

Last Updated on January 16, 2024 by admin

We originally published this article in April 2021, but we’re revisiting it because B2B fintech marketing best practices change, and we’re due for an update in January 2024.

B2B fintech products and services are some of the most challenging to market and sell. These solutions tend to be complex, excruciatingly technical, and, well, a tad bit dry to read or hear about. Since decision-makers that B2B fintechs try to reach are usually within banks, financial institutions, retailers, and other businesses, the content that they produce tends to err on the side of super serious. We’ve all seen the in-depth reports about the state of fintech for [insert current year here]. Yawn.

Here’s the thing: just because you’re addressing a business audience doesn’t mean you’re not talking to other people. People respond best to interesting, engaging, and interactive content, and there’s no reason that B2B fintechs can’t take a page from the B2C playbook on those tactics.

The challenge is that many B2B fintech marketers are afraid to get too “fresh” and risk offending their business audience. We counter that it’s much more offensive to bore them to death with desperately dry marketing materials that lack any real-world appeal. To combat this growing problem, we’ve outlined some B2B fintech marketing best practices to ensure that your marketing and content don’t…suck.

The Top B2B Fintech Marketing Best Practice Is To Have a Plan

The days of haphazard, piecemeal marketing programs are over. The digital landscape — where most people are consuming the majority of their information — is crowded. To compete, you must have a data-driven strategy that aims to meet your target audience where they are and address their most pressing problems. That’s why the top B2B fintech marketing best practice is to have a plan.

Gather Data

- Conduct a competitive analysis: Take a look at your competitors’ websites to discover what topics their content covers, where they promote that content, and how they interact on social media.

- Don’t just copy; do it better. Look for content gaps (what haven’t they covered) and provide thought leadership.

- Do keyword research: Tap into one of the leading tools (Moz, SEMrush, etc.) available to help you build a solid keyword strategy. Find your core keywords (those that best describe your product/service) and build out your long-tail keywords. Use Google Keyword Planner to discover how people are searching and what they’re searching for.

- Create an “intent funnel” so you can target clients at all different states of intent.

- Identify trending topics: Check out which related topics are trending in searches. Use Google Trends and Twitter trends to identify hot topics related to your industry.

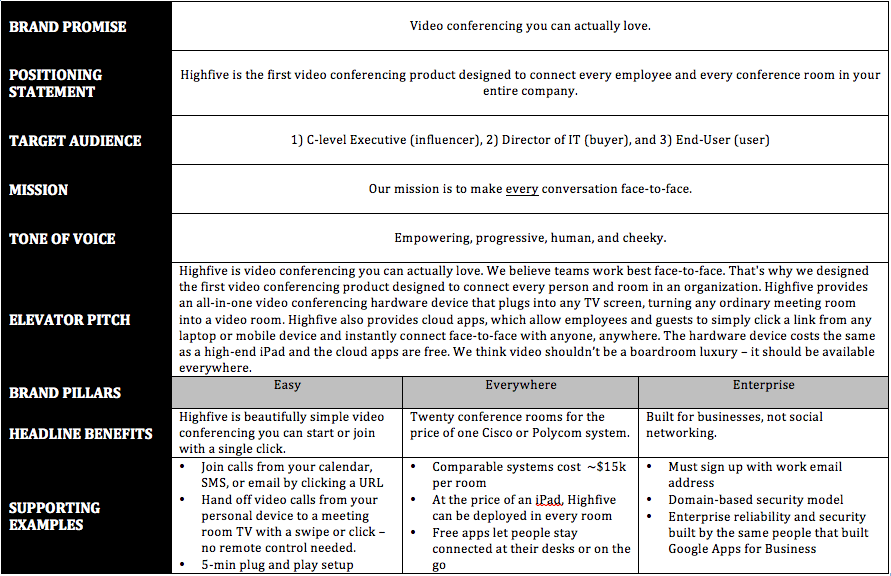

Create a Messaging Matrix

B2B fintech marketing is complex, but the messaging shouldn’t be. Creating a messaging matrix can set the foundation for how you will build relationships with different segments of your audience via personalization. A messaging matrix is helpful for both marketing and sales departments and ensures that messaging and voice remain consistent across all use cases.

To create a messaging matrix, be sure to include:

- Audience personas

- High-level messaging that includes value prop and key benefits

- Competitive positioning and messaging

- Sales conversation messaging and guidelines for how to handle specific objections

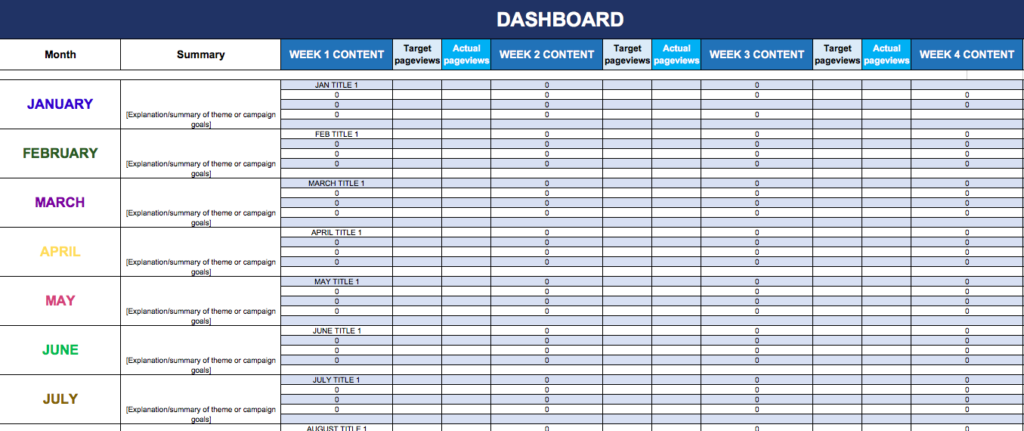

Build a Content Calendar

Once you have all the data you need to inform your strategy, you can start to set it down on paper/Google Sheets. Use the content calendar as a framework for your strategy and determine which topics you cover, how frequently you’ll publish content, and where you’ll promote that content. By using a calendar format, you can plan specific campaigns around certain dates that may be important for your business or industry.

Don’t Overlook the Importance of Emotion

Just because you’re focused on B2B marketing doesn’t mean you’re not selling to people. People have emotions and your buyers – no matter how sophisticated – are still subject to those emotions (they are human, after all).

While emotional appeal may seem like a pie-in-the-sky, unmeasurable objective, it’s not. Consider this exercise:

Reference your existing content inventory (you can also do this as part of a new content audit) and label each piece of content with a primary emotion and a secondary emotion. For example, if you’re a fintech that provides chargeback protection, you might have a few pieces on the cost of chargebacks for merchants (fear), how chargeback protection can help you build better relationships with your customers (potential), why you’re the ideal chargeback prevention provider (trust), and how adequate chargeback prevention might help merchants broaden their product offerings or cater to customers they otherwise might not be able to (inclusion).

Next, look at the analytics tied to each piece of content. Which emotions compel your audience to take action — and what action? For example, you might identify a trend where customers download an ebook on chargeback worst-case scenarios and then download the case study. This demonstrates that fear is a compelling emotion that your audience responds to. You might also notice that a piece that highlights potential positive outcomes drives a lot of awareness traffic to your site but people seem to fall off after reading.

This data can inform your content strategy moving forward. For example, you might consider closing out your positive outcomes piece with a CTA that encourages people to download the ebook on merchant chargeback horror stories.

Emotion is measurable and it’s an often overlooked key ingredient for successful marketing and content marketing campaigns. Don’t sleep on this B2B fintech marketing best practice.

Psychology is Your Friend

Piggy-backing off of the importance of emotion, psychology is an important component of effective marketing.

It’s essential to hit on the appropriate emotional responses we described above. You need to deeply understand how your customers think and feel. It’s not just a guess, either. You should conduct research to identify the factors that impact B2B purchasing decisions and use those to inform your content and campaigns.

You might use tools like heat mapping to identify “hot spots” on your website. AI can be tapped for sentiment analysis to understand how different campaigns and content pieces make people feel. All of this can be used to craft a marketing strategy around your unique B2B buyer journey.

Analytics are a key component to effective neuromarketing. You’ll need tools that help you glean insights and put those insights to good use. Psychology is foundational to most B2B fintech marketing best practices.

Mix Up Your Media

Once you have the framework for your content strategy and have given adequate consideration to the emotional component, you can start to execute. Content marketing is not a “set it and forget it” thing, so you’ll always be iteratively improving on the plan based on metrics you track over time. One of the easiest ways to make some changes is to switch up the content formats you work within.

You may have started publishing simple blog posts. As your B2B fintech marketing program matures, you’ll want to experiment with different types of content. Your audience might be more inclined to look at an infographic than read through a blog post. Or perhaps your audience is looking for more in-depth information like a report or a white paper. Video is another great medium to convey messages in an interesting way. The point is to experiment with different content formats and find which works best for your audience.

Don’t forget the emotional component! Some media may pack more punch than others, depending on the topic. For example, a first-person story told on a podcast about a merchant who had a chargeback crisis could be more compelling for other merchants to hear than to read. Similarly, strong statistics or data points on the cost of chargebacks could be more interesting told as a visual story (infographic). Different formats can also complement each other. Add infographics to spice up blog articles and include snippets of relevant videos or podcasts to underscore key points.

Get Personal

AI and other tech have made it much easier to customize and personalize content for your audience and audience segments. It’s not optional today. Hyper-personalization is a huge emerging trend for 2024. Deloitte released a white paper about how data, analytics, and AI all work together to enable this sophisticated level of personalization.

The gist is that customer expect businesses to understand and anticipate their wants and needs — and deliver content, products, and services that meet them. Since COVID, you’ve probably heard a lot about robust marketing strategies — especially ones that skew digital — but that simply isn’t enough anymore.

Modern marketing requires a careful, nuanced approach that focuses on digital-first, personalized experiences that leverage data to meet customers where they are.

The prevalence and availability of customer data mean that not only is hyper-personalization possible, but it is also expected. And your competitors are doing it. It requires a tailored customer journey informed by industry-specific customer insights.

Not only does hyper-personalization help you meet customer expectations, but it is essential for maximizing revenue, reducing customer acquisition and retention costs, and improving the customer experience.

B2B Fintech Marketing Best Practices Aren’t Stagnant

The same principle holds for how you distribute content and reach your audience. Maybe your initial strategy revolved around posting to your company’s LinkedIn page. Again, as your B2B fintech marketing program becomes more sophisticated, you want to expand how you deliver messaging and content to your audience.

This should also be a data-driven endeavor. If you’re just starting, building audience personas should help you identify where your audience consumes information. You can also seek out data about the best days of the week to post content on certain social media channels. Once you have a few months under your belt, you can begin to identify how your specific audience responds to how and where you promote your content and adjust accordingly. You may find that retargeting/remarketing is a helpful distribution strategy for boosting awareness of your content, while email marketing leads to higher engagement levels.

The bottom line is that your B2B fintech marketing should continue to evolve and mature over time, and this will require an ongoing level of evaluation and iterations to your marketing strategy. As you gather more data, your strategy will continue to grow and become more successful. More people than ever are turning to online channels to consume information to gather research to make purchasing decisions. Following these B2B fintech marketing best practices can position you to intersect with the buyers seeking products and services like yours.

Want More B2B Fintech Marketing Best Practices?

Looking for more in-depth B2B fintech marketing best practices, tools, and content? Check out one of our helpful guides:

- Fintech Demand Generation Playbook

- Fintech Customer Acquisition Playbook

- B2B Fintech Lead Generation & Marketing During a Recession

- Fintech Marketing Playbook (chock full of B2B fintech marketing best practices)

- Payments Thought Leadership Playbook

- The Financial Marketer’s Guide to Content Marketing