Table of Contents

Welcome to the world of fintech marketing, where innovation and strategy meet to shape the future of finance. In this four-part guide, we’ll look at the current landscape of fintech marketing, explore how it’s changing, and dive deep into the strategies and tactics you’ll need to be successful in 2024 and beyond.

The Transformative Power of Fintech Marketing

Imagine a world where traditional financial services are transformed into seamless digital experiences, where access to capital, investments, and financial advice is at your fingertips. This is the world of fintech, and it’s a rapidly evolving sector that’s rewriting the rules of finance.

In recent years, the fintech industry has witnessed unprecedented growth. According to Boston Consulting Group, fintech revenues are expected to grow sixfold to $1.5 trillion by 2030. This isn’t just a niche market; it’s a thriving ecosystem of disruptors challenging the status quo.

But amidst this vibrant landscape, competition is fierce. With thousands of fintech startups and established players vying for attention, how do you stand out? The answer lies in fintech marketing.

Consider these B2B fintech stats:

- The embedded payments industry is on track to grow 45% from $43 billion in 2021 to $138 billion in 2026.

- 60% of B2B buyers would consider making purchases through marketplaces

- More than half (55%) of organizations expect up to a 30% rise in demand on their AP systems in the next three years

- Large enterprises with digitally savvy executive teams outperformed their counterparts without such teams by more than 48%

They all highlight pressing needs and concerns that B2B organizations have – things that fintech can address. But it requires great marketing, which requires buy-in from leadership.

Just listen to Payal Raina, Founder of Fintech B2B Marketing, about why fintech marketing deserves attention as a commercially-driven function (rather than just a support function) and how it impacts the bottom line:

With the right internal support and resources, you can develop a fintech marketing plan to meet the expectations of your B2B buyers.

Your audience needs to know how your fintech solution can make their lives easier, safer, and more profitable. It’s not enough to have a brilliant product; you need to convey its benefits clearly and persuasively.

Keeping Fintech Marketing Relevant

Fintech marketing isn’t static; you have to be flexible and adapt. As technology advances and consumer behaviors shift, staying relevant is an ongoing challenge.

In the wake of the COVID-19 pandemic, consumers and businesses alike have accelerated their adoption of digital financial tools. McKinsey reports that the crisis has accelerated digital banking adoption by several years in just a matter of months. That’s not all: the rate at which companies are developing new products and services has, on average, experienced a 7-10 year increase!

This shift in behavior presents both opportunities and challenges for fintech marketers. On one hand, the demand for digital financial solutions has never been higher. On the other, competition is intensifying as established players and newcomers alike rush to meet this demand.

In many ways, B2B fintechs are in uncharted territory. They always have been; however, the stakes are higher and the timelines are faster. Success hinges on an effective fintech marketing strategy that allows you to harness the many opportunities presented by the digital transformation of finance.

Fintech marketing is your ticket to growth, your key to unlocking the vast potential of the fintech industry. It’s how you connect with your audience, differentiate your brand, and adapt to a rapidly changing landscape.

In the sections that follow, we’ll dive deep into the strategies and tactics that will separate the nonsensical time-wasters from the stuff you can use to grow. From content marketing to social media engagement, we’ll equip you with the knowledge and tools needed to thrive as your fintech marketing matures and evolves.

But remember, success in fintech marketing isn’t just about following trends; it’s about understanding your audience and delivering real value. So, let’s dive in and explore the ins and outs of fintech marketing to unlock the full potential of your fintech venture.

Understanding the Fintech Audience

Fintech marketing success begins with a deep (and clear!) understanding of your audience. For B2B fintech companies looking to market their services to other businesses, this knowledge is not just valuable; it’s absolutely essential. In this section, we’ll delve into why comprehending your fintech audience is pivotal for your marketing endeavors.

Fusing Fintech Needs + Personality: Identifying Target Personas

You wouldn’t go on a road trip without knowing your destination, so why would you launch any fintech marketing campaign without knowing who you’re trying to reach? Treat your target audience like a destination. To get there, you need a clear understanding of who they are, otherwise, you’re navigating blindly. Once you understand your audience, you can create a precise roadmap.

This is where audience personas come into play. By creating detailed fintech audience personas, you’re not shooting in the dark; you’re aligning your marketing efforts with the unique needs and pain points of your ideal customers. These personas aren’t generic; they’re finely crafted representations of the businesses you aim to serve.

If you’re new to the concept of audience personas or need a refresher, check out our comprehensive guide on “How to Create a Strong Fintech Audience Persona.” It provides step-by-step insights into crafting personas that resonate with your fintech marketing strategies.

But why is this step so crucial? The answer lies in the data. According to HubSpot, businesses that use audience personas in their marketing efforts are two to five times more effective at reaching their target audience. Overlook personas and you’ll lose money (and time and energy) down the road, trust us.

Research-Driven Insights: Customer Pain Points and Needs

Knowledge is power. And the knowledge that truly empowers you is the one that comes from research—research that uncovers the pain points and needs of your target audience.

Your prospective B2B clients in the fintech sector have specific challenges, and it’s your job to identify them. Whether it’s streamlining financial operations, enhancing cybersecurity, or optimizing payment processes, understanding these pain points is your gateway to providing solutions that resonate.

B2B clients are looking for tailored recommendations to solve their biggest challenges. To meet these expectations and create compelling fintech marketing campaigns, you need to be armed with insights gathered through market research.

To gather these insights, consider the following sources:

Analytics – collect and analyze demographic and geographic along with how these visitors spend time on your site. This can unlock insights about what type of content they enjoy, which problems they’re trying to solve, and how they prefer to consume content.

Sales Team – Talk to the front lines of your organization to see what prospective customers are saying throughout the buyer’s journey. Identify key obstacles and objections as well as questions that might come up frequently. Frequently asked questions could point to areas where your content needs to do a better job explaining things or highlighting impacts.

Your Audience – Surveys, polls, and your own inbox are another way to get into the minds of your customers. Connect with your social fans and followers, customer service interactions, and current customers/clients to gather information that can feed your strategy.

Industry and Market Research – Anecdotal evidence is great but scrub it against hard, quantitative data to see what your audience wants and needs.

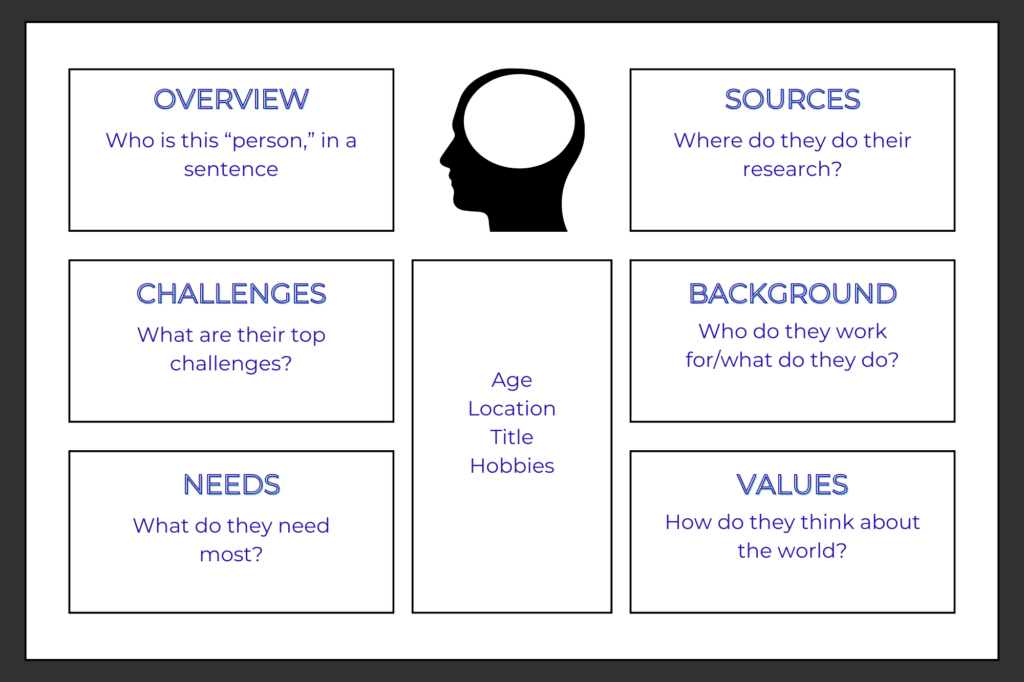

With the right data in hand, you should be able to craft a meaningful audience persona that includes:

- Overview – Who is this “person,” in a sentence

- Challenges – What are their top challenges?

- Needs – What do they need most?

- Information sources – Where do they do their research?

- Background/company information – Who do they work for/what do they do?

- Values – How do they think about the world?

This information can turbocharge everything you do in fintech marketing. Without it, you’re dead in the water.

Fintech Marketing to Address Specific Customer Challenges

Now that you’ve identified your fintech audience and understood their pain points, it’s time to demonstrate how your solutions address these specific challenges. This is the cornerstone of effective fintech marketing.

Your audience isn’t just looking for information; they’re seeking solutions that can transform their business operations. Your role as a B2B fintech marketer is to bridge the gap between their pain points and your services.

One way to accomplish this is through content that showcases real-world examples. Case studies, success stories, and video testimonials provide tangible evidence of how your fintech solutions have made a positive impact on businesses similar to your target audience – but we’ll get into more detail on this later.

Understanding your fintech audience isn’t an optional step in your marketing strategy; it’s a strategic imperative. Crafting detailed audience personas, conducting thorough research, and showcasing how your solutions address specific challenges are the building blocks of effective fintech marketing.

Brand Identity: The Foundation of a Fintech Powerhouse

Your brand is your beacon, guiding potential clients to trust and choose your services in an increasingly crowded market. Whether you’re an established player or a rising star, building a robust fintech brand identity is the key to differentiation and growth. In this section, we’ll explore the strategies and tactics to help you create a fintech brand that stands out and resonates with other businesses.

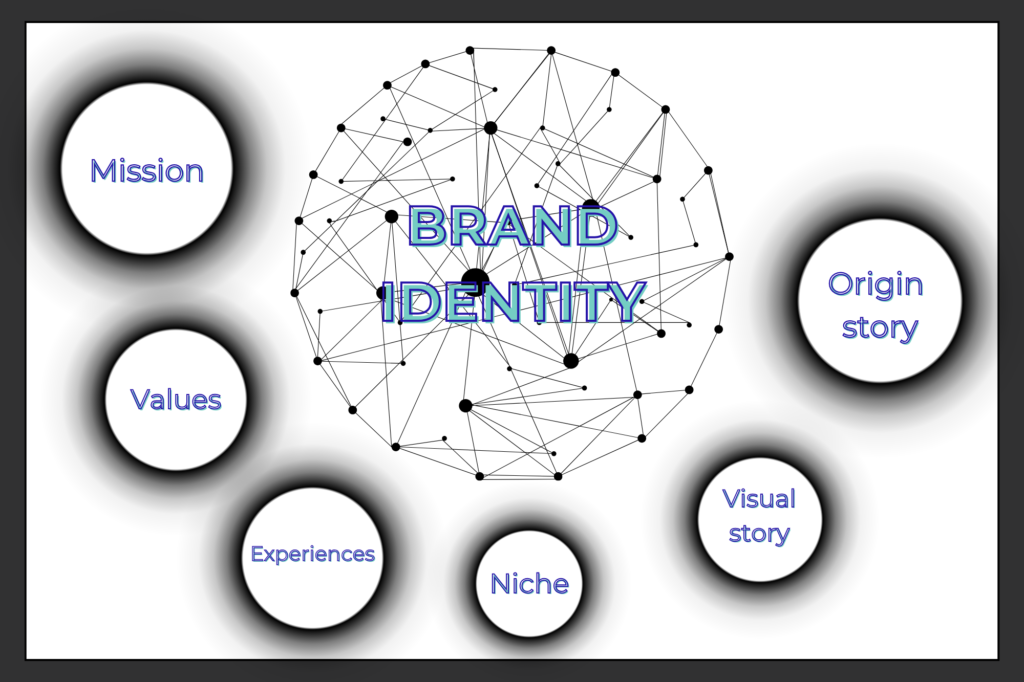

Defining Your Fintech Brand Identity

Imagine your brand as the face of your fintech company—a face that clients, partners, and investors will come to recognize and trust. But for your brand to resonate, you first need to define its identity.

Start by crafting a compelling brand story. Your story should convey your fintech’s journey, its mission, and the unique value it offers. Take Stripe, for instance. Their brand story revolves around simplifying online payments, making it easier for businesses to accept payments and thrive. Your brand story should be relatable, resonating with the challenges and aspirations of your target B2B audience.

To define your brand values and mission, think about the core principles that drive your fintech. Are you all about transparency, innovation, or security? Make these values explicit, as they’ll serve as the foundation of your fintech brand identity.

The Role of Thought Leadership in Fintech Branding

Thought leadership is your ticket to credibility and authority. It’s about positioning your fintech as a trusted expert in your field – a source of insights and guidance that others turn to.

To establish thought leadership, start by sharing your expertise through various content channels. Write insightful articles and blog posts, contribute to industry publications, and participate in webinars and conferences. Your goal is to showcase your knowledge and passion for fintech, positioning yourself as a valuable resource for your B2B audience.

Take a page from the playbook of Adyen, a global payment company. They regularly publish thought leadership content that dives deep into industry trends and challenges, showcasing their expertise and commitment to their clients’ success.

Fintech Branding In Action

One of the most effective ways to understand how to build a strong fintech brand is to learn from those who have done it exceptionally well.

Square, for example, has mastered the art of branding in the fintech space. They’ve built a brand that’s synonymous with simplicity and accessibility in payments. Square’s iconic white payment terminals and user-friendly design communicate their commitment to making financial tools accessible to businesses of all sizes.

Another remarkable example is Brex, a fintech company that provides corporate credit cards to startups. Brex has built its brand around understanding the unique needs of emerging businesses. They offer tailored solutions and leverage their expertise in fintech to create a brand that resonates with startups seeking financial flexibility and support.

Crafting Your Fintech Brand Identity

Looking at behemoth winners in the space can provide inspiration, but your brand identity has to be yours alone. To craft your brand identity, ask yourself:

- What is our fintech’s origin story, and what makes it unique?

- What values drive our business, and how do they align with our mission?

- How can we establish thought leadership in our niche?

- What visual elements and design principles will reflect our brand identity?

Remember, your fintech brand identity isn’t just about a logo or a catchy tagline—it’s about the sum of your brand story, values, and the experiences you create for your clients.

Remember: this will be an ongoing process. Consistency in messaging, design, and customer experience will reinforce your brand identity over time. And, most importantly, always listen to the feedback and needs of your B2B clients. Your fintech brand should evolve and adapt to meet their changing demands and expectations.

A strong brand identity is your anchor; it’s what sets you apart and gives you a competitive edge. So, don’t be shy when it comes to defining your story, establishing your values, and showcasing your expertise.

That’s a wrap for the first in this four-part series. Stay tuned next week for our special insights on how to succeed with content marketing and email.

Additional Tools for Your Fintech Marketing Strategy

Looking for more in-depth fintech marketing tools and content? Check out one of our helpful guides: